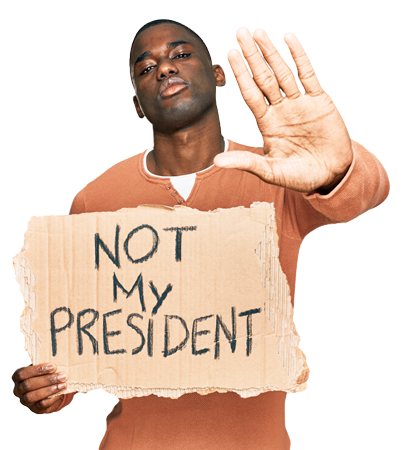

Types of Cover

Property Damage Cover

Protects your property against damage caused by political riots or civil disturbances.

Business Interruption Cover

Covers loss of income and operating expenses if your business is disrupted by a riot.

Third-Party Liability Cover

Provides protection against legal claims arising from damages caused by political unrest.

Dedicated claims support and risk management services to help you minimize downtime and maximize recovery